G20 membership, lalalala everything will be just fine, okay!

Go Lafayette, go!!!

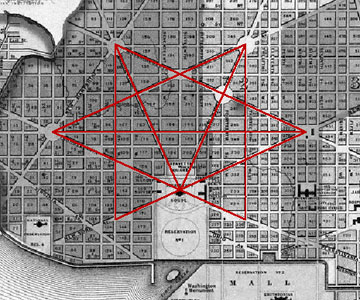

The G20 meeting is less than a week away, set to occur on Saturday November 15th in the satanic capital of the world, otherwise known as Washington, DC. The global banker syndicate will include the Group of 7 industrialized nations (US, Germany, France, etc), as well as 'developing' nations which comprise the G20, including powerhouse net creditor nations such as Brazil, Russia, India, and China (BRIC).

Putin prepares to send a Topol-M down your stack

The agenda of the meeting is what is under question. This may include the end of the US Dollar as the sole global reserve currency. Rumors are flying, including the possibility that trade out of the Eastern Bloc , aka the SCO, will be pegged to a basket of currencies rather than simply dollars. This would facilitate bilateral trade between Russia and China, at the expense of US Dollar, due to the vast current account deficits which the United States must presently finance with borrowed money from the Chinese, Japanese, Russians, and Arabs.

Don't you wish you were the blue line...

The stage is set for a global economic meltdown, the perfect pretext for a 'new world' financial system to be established very quickly, possibly in under 90 days according to the Brazilian Finance Minister.. The US Dollar is the big question. The other big question is whether the meeting ends in chaos or 'results'. Your guess is as good as mine. I would suggest the meeting ends in chaos, due to contrived 'rebellion' from the BRIC nations. Then perhaps we are in for another dose of economic pain before Americans cave in to the austerity demands of their foreign creditors.

Remember, although the United States Dollar may be the world's reserve currency, we are also the largest debtor nation in the history of the planet. Creditors dictate the terms to the debtor, not the other way around. Global Tinfoil suggests you hedge your portfolio against currency risk, or else you may end up like the failed northern utopia called Iceland.